Commercial vs Residential Investment has always been a major point of discussion for anyone entering real estate. Real estate is considered one of the most reliable investment options, but once you decide to invest, a common question arises: Should you invest in commercial property or residential property?

Both options offer unique advantages and risks. In 2026, with changing work patterns, evolving cities, and new infrastructure projects, the difference between commercial and residential investment has become even more important to understand.

This guide breaks down Commercial vs Residential Investment real estate in a simple, practical way so you can decide what suits your goals best.

Before comparing returns and risks, it’s important to understand what each category includes.

Residential investment typically includes:

- Apartments and flats

- Villas and independent houses

- Rental homes for families or individuals

Commercial investment usually includes:

- Office spaces

- Retail shops and showrooms

- Warehouses and logistics parks

- Business parks

Both generate income and appreciation, but they behave very differently.

Residential Investment: Key Benefits

1. Steady and Consistent Demand

Housing is a basic need. Regardless of market conditions, people need space to live. This makes residential real estate more stable during economic slowdowns.

Rental demand in residential properties usually remains consistent, especially in well-connected urban locations.

2. Lower Entry Cost

Residential properties generally require:

- Lower capital compared to commercial assets

- Smaller down payments

- Easier home loan availability

This makes residential investment more accessible for first time investors.

3. Easier to Understand and Manage

Most investors are already familiar with residential property because they live in one. Managing a residential unit is relatively simple, and tenant expectations are straightforward.

Vacancy risks are also easier to manage since the tenant pool is large.

4. Long-Term Capital Appreciation

In growing cities and infrastructure-driven locations, residential properties tend to appreciate steadily over time. Areas with metro connectivity, airports, and employment hubs often see sustained value growth.

Residential Investment: Limitations

Residential investment also has its challenges.

- Rental yields are usually lower compared to commercial properties

- Tenant turnover can be frequent

- Rent control or local regulations may limit rental increases

- Maintenance costs can add up over time

Residential investment works best for long-term investors who prioritize stability over high monthly income.

Commercial Investment: Key Benefits

1. Higher Rental Yields

One of the biggest advantages of commercial real estate is higher rental returns. Commercial properties often generate better monthly income compared to residential units of similar value.

Longer lease agreements provide predictable cash flow.

2. Long-Term Lease Security

Commercial tenants usually sign long-term leases, often ranging from 3 to 9 years. This reduces vacancy risk and provides income stability.

Tenants also tend to maintain the property better since it affects their business image.

3. Professional Tenants

Commercial tenants are businesses, not individuals. This usually means:

- Better payment discipline

- Fewer emotional issues

- Clear lease terms

For investors, this can reduce management stress.

4. Inflation Protection

Commercial leases often include escalation clauses, which increase rent periodically. This helps protect returns against inflation.

Commercial Investment: Risks to Consider

Despite higher returns, commercial investments carry higher risks.

- Higher entry cost

- Larger capital requirement

- More sensitive to economic cycles

- Vacancy periods can be longer

- Financing options may be limited or costlier

If a commercial tenant leaves, finding a suitable replacement can take time, especially in slow market conditions.

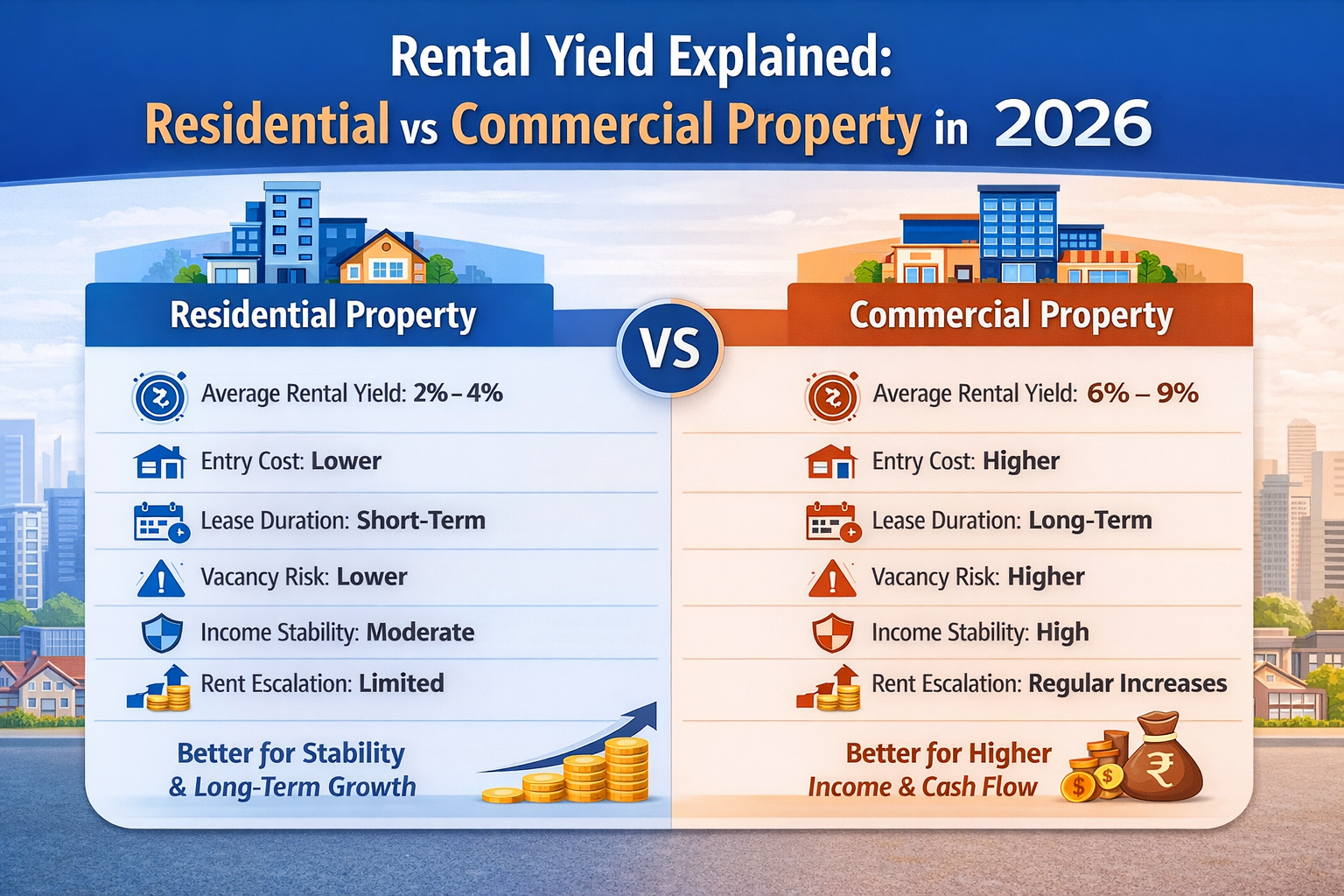

Commercial vs Residential Investment : Side-by-Side Comparison

Factor |

Residential Investment |

Commercial Investment |

|

Entry Cost |

Lower |

Higher |

|

Rental Yield |

Moderate |

Higher |

|

Vacancy Risk |

Lower |

Higher |

|

Lease Duration |

Short term |

Long term |

|

Ease of Management |

Easier |

More complex |

|

Financing |

Easily available |

Limited options |

|

Market Sensitivity |

Lower |

Higher |

Which Investment Is Better for You?

The better option depends on your goals, risk appetite, and investment horizon.

Residential Investment Is Better If :

- You are a first-time investor

- You want stable, long-term growth

- You prefer lower risk

- You need easier financing

- You want flexibility to sell or self-use later

Residential real estate suits conservative investors focused on wealth creation over time.

Commercial Investment Is Better If:

- You have higher capital to invest

- You want high monthly rental income

- You are comfortable with market cycles

- You prefer long-term lease security

- You understand business location dynamics

Commercial real estate suits experienced investors seeking income-focused returns.

Commercial vs Residential Investment market trends to watch in 2026

In 2026, several trends are shaping both segments:

- Infrastructure-led growth is boosting residential demand in emerging locations

- Hybrid work models are redefining office space demand, not eliminating it

- Retail and logistics spaces are seeing renewed interest due to E-Commerce growth

- Mixed-use developments are blending residential and commercial benefits

Understanding these trends helps investors choose the right asset in the right location.

Can You Invest in Both?

Yes, many seasoned investors balance risk by diversifying across residential and commercial assets.

A common strategy is:

- Start with residential property for stability

- Add commercial assets later for income diversification

This approach combines steady appreciation with higher rental yields.

Final Thoughts

There is no one-size-fits-all answer to Commercial vs Residential Investment.

Residential real estate offers stability, easier entry, and long-term appreciation. Commercial real estate offers higher income potential but comes with higher risk and capital requirements.

The right choice depends on your financial capacity, investment goals, risk tolerance, and understanding of the market.

A well-planned real estate portfolio is not about choosing one over the other. It is about deciding what fits your strategy at the right time.