Rental Yield, from a developer’s perspective, is not a marketing promise. It is a reality check.

Before a project is designed, priced, or launched, developers study whether the location can support healthy rental demand over the long term. A project that cannot sustain rental income often struggles with resale value, occupancy, and overall market confidence.

Understanding how developers evaluate rental yield and ROI helps buyers and investors make decisions based on fundamentals, not assumptions.

Why Rental Yield Matters to Developers

For developers, rental yield answers one core question:

Will people actually want to live or work here consistently?

A project with strong rental fundamentals:

- Attracts end users and investors

- Maintains steady occupancy

- Supports resale demand

- Holds value during market cycles

- If rental demand is weak, no amount of branding can sustain long-term value.

How Developers Study Rental Demand

Developers do not start with pricing. They start with demand.

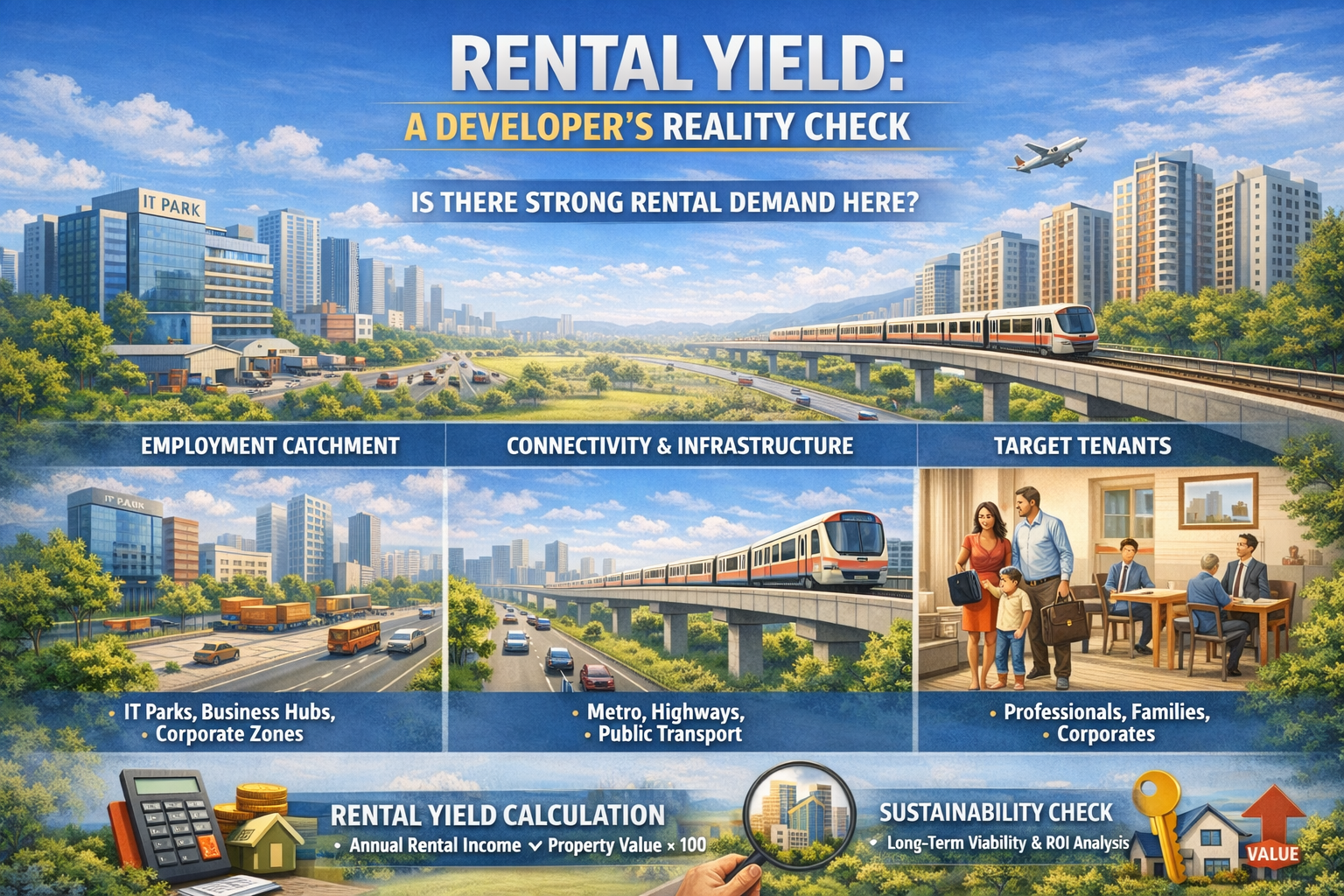

Employment Catchment

Rental demand comes from employment. Developers analyse:

- Nearby IT parks and business hubs

- Industrial and commercial zones

- Corporate leasing activity

- Travel time from workplaces

If a location does not support daily commuting needs, rental yield will always be under pressure.

Connectivity and Infrastructure

From a developer’s view, connectivity directly impacts rentability.

Key checks include:

- Railway, metro, and road access

- Future infrastructure timelines

- Traffic movement and entry points

- Public transport availability

Good connectivity expands the tenant pool and stabilizes rental pricing.

Tenant Profile Planning

Every project is designed with a target tenant in mind.

Developers identify whether the demand is for:

- Working professionals

- Families

- Corporate leasing

- Mixed tenant profiles

Unit sizes, layouts, and amenities are planned accordingly. Rental yield improves when product design matches tenant expectations.

How Developers Calculate Rental Yield

Developers use conservative numbers, not optimistic projections.

Step 1: Real Market Rent Assessment

Developers study:

- Actual rental values in nearby projects

- Occupancy rates

- Furnished vs unfurnished demand

- Historical rent escalation

Rental assumptions are based on what tenants are currently paying, not future speculation.

Step 2: Pricing Alignment

Rental yield is calculated using:

Annual Rental Income ÷ Expected Property Value × 100

If rental yield falls too low, developers reconsider:

- Unit pricing

- Product mix

- Unit sizes

- Target buyer profile

Yield acts as a pricing discipline tool.

Step 3: Sustainability Check

Developers ask:

- Can rental income cover maintenance expectations?

- Will tenants stay long term?

- Is the project competitive five years from now?

Short-term yield without sustainability leads to poor resale performance.

What ROI Means to Developers

For developers, ROI is not just rental income. It is the combination of:

- Rental stability

- Capital appreciation

- Liquidity

- Project reputation over time

A project with balanced ROI creates confidence across buyers, lenders, and future investors.

Residential vs Commercial: Developer Reality

Residential Projects

Developers focus on:

- Stable, broad demand

- End-user confidence

- Long-term liveability

- Consistent resale activity

Rental yields may be moderate, but appreciation and liquidity are stronger.

Commercial Projects

Developers prioritise:

- Tenant quality

- Lease tenure

- Rental escalation clauses

- Business ecosystem strength

Commercial assets offer higher yield but require precise location and tenant planning. Mistakes are costlier.

Design Decisions That Improve Rental Performance

From a developer’s standpoint, rental yield is influenced heavily by design.

Key decisions include:

- Efficient layouts with minimal wasted space

- Practical unit sizes

- Good ventilation and daylight

- Durable, low-maintenance materials

- Functional amenities over decorative features

Good design reduces vacancy and increases tenant retention.

What Developers Want Buyers to Understand

Rental yield should be realistic, not exaggerated.

From a developer’s view:

- Residential real estate is a long-term asset

- Rental income supports holding costs

- Appreciation builds wealth over time

- Guaranteed returns are not sustainable

Projects built on fundamentals outperform those built on promises.

Common Misunderstandings Developers See

Developers often encounter buyers who:

- Expect commercial yields from residential property

- Ignore vacancy and maintenance costs

- Focus only on short-term returns

- Compare unrelated locations directly

Rental yield must always be viewed in context.

How Developers Measure Project Success

For developers, success is seen when:

- Units are easily rented

- Tenants stay longer

- Resale demand remains strong

- Property value grows steadily

Strong rental performance validates the original planning and location selection.

Final Thoughts from a Developer’s Perspective

Rental yield is not a sales metric. It is a reflection of demand, design, and discipline. Developers who focus on rental fundamentals create projects that perform well across cycles. Buyers who understand rental yield from a developer’s perspective invest with clarity and patience.

In real estate, sustainable returns are built, not advertised.